Background

In 2021, the Government signalled that it is initiating a review of the Working for Families (WFF) package. WFF provides crucial income support for children in low-income households, and is therefore a critical means of addressing entrenched child poverty in Aotearoa.

CPAG has long advocated for reform to the flawed design of the package. This page summarises some of our recent 2021 research, highlighting two key policy asks of the Government as it conducts this review.

Ensuring all children in low-income households benefit from the full WFF package

CPAG has long advocated for the extension of the In-Work Tax Credit (IWTC) to all children in low-income households, regardless of the paid work status of their parent(s) or caregiver(s).

The WFF package as it stands is depriving children in benefit-receiving households of significant resources. As Table 1 below demonstrates, a one- to three-child family on a benefit will have missed out on $18,850 in the five years to 2023, with even bigger losses for larger families.

Table 1: Total nominal annual WFF tax credits for 1-6 children families, with and without the IWTC as at July 2021

The New Zealand system – which discriminates between ‘deserving’ children (whose parents are not on any benefit) and the ‘undeserving’ (whose parents are on a benefit) – stands in stark contrast to the treatment of children in the Australian system. In Australia, all children in low-income households are treated the same – they receive the same levels of child-related family assistance, regardless of the paid work status of their parent(s) or caregiver(s).

Table 2 below demonstrates the relative generosity of the Australian tax credit system compared to the New Zealand system, particularly for those families receiving benefits. Over the course of the year July 2021-22, a three-child family in Australia receiving a benefit will be roughly $8,300 better off (before exchange rate is accounted for) compared with their counterparts in New Zealand.

Table 2: Comparison of family assistance NZ vs Australia for families on- and off-benefit, July 2021-2022*

The extension of the In-Work Tax Credit would be a cost-effective and highly targeted measure to address deep child poverty; CPAG estimates it would cost between $500 and $600 million per year. We are calling on the Government to ensure all children in low-income households have access to the full WFF package as part of their upcoming review of WFF.

For full detail on the Australian family assistance scheme compared to Working for Families see Part 2 of CPAG’s 2021 series, Rethinking Income Support for Children: Australia and NZ tax credits for children. A 5-year comparison: 1 July 2018 – 1 July 2023.

Ensuring the Working for Families package is fully indexed

Unlike core benefits and NZ Superannuation, which are both now indexed to movements in wages, the Working for Families is not wage-indexed. The package is only partially indexed to inflation, meaning that one-off increases to tax credit rates are quickly eroded in relative value.

Wage-indexation of the package is crucial to ensure that increases such as those included in the 2018 Families Package are ‘baked in’. Our modelling in Part 1 of CPAG’s 2021 series, Rethinking Income Support for Children: Ensuring Adequate Indexation of Working for Families, suggests that the Families Package largely reflected a 10- to 11-year catch-up on erosion in relative value due to the lack of wage indexation.

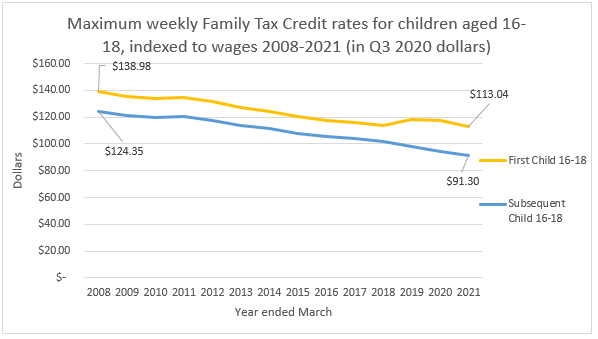

The two graphs below demonstrate how the Families Package increases in the year ending March 2019 merely restored rates to roughly their 2008 levels in wage-adjusted terms, rather than delivering any substantial increases. Erosion in value has been more significant for young people aged 16-18, albeit starting from a higher point (see Graph 2 below).

Graph 1: Maximum weekly FTC rates for children 0-12, indexed to wages 2008-21 (in Q3 2020 dollar terms)

Graph 2: Maximum weekly FTC rates for 16-18 year olds, indexed to wages 2008-2021 (in Q3 2020 dollar terms)

Without proper indexation, the gains made from one-off increases such as the Families Package are lost, as is evident in the relative erosion since 2019.

We are calling on the Government to ensure all Working for Families payments are wage-indexed as part of their upcoming review of Working for Families.

WORKING FOR FAMILIES TAX CREDITS (WFF) – Q & A

Brief Overview and Q&A

This brief overview sets out the core components of WFF and is designed to provide a quick guide. It is not exhaustive; any reader seeking more information should look at the MSD Publication The New Zealand Income Support system as at July 1, 2022 or go to the Inland Revenue website - https://www.ird.govt.nz/working-for-families/about.

1. What is Working for Families (WFF)?

WFF is a set of tax credits paid by government to the caregiver in families with dependent children; as it is a payment to support families with children, it cannot be described as a subsidy to employers as some commentators have done.

2. What are the different parts of WFF?

a. Family Tax Credit (FTC)

b. In Work Tax Credit (IWTC)

c. Minimum Income Tax Credit MITC)

d. Best Start Tax Credit BSTC)

[Note: Independent Earner Tax Credit (IETC) is not part of WFF and paid only to those in low paid work without children and not eligible for WFF; it is not included here].

3. Who is eligible for each of the different parts of WFF?

a. Family Tax Credit (FTC)– Families with a low income whether receiving a benefit or not.

b. In Work Tax Credit (IWTC)– Families in paid work, not on a benefit

c. Minimum Family Tax Credit (MFTC) – top up for families in low paid work, not on a benefit and working 20 hours as a sole parent or 30 hours a week for a couple .

d. Best Start Tax Credit (BSTC) – Paid (after paid parental leave ceases) to all families with a child under one and income tested for families with a child between one and three.

4. How do the different parts of WFF link together?

a. Recipients in paid work may receive both the FTC and the IWTC, but only if no benefit or part benefit is paid regardless of paid work effort.

b. Recipients in paid work may also receive the MFTC and the IWTC. They would also receive the FTC.

c. Those receiving the BSTC may also receive other WFF tax credits.

5. What are the payment rates (1 April 2024) for the different parts of WFF? [Note: these are maximum rates which will vary depending on income and the number of children]

a. FTC - $144.00 maximum for first child and $117.00 for each additional child.

b. IWTC - $72.50 for 1-3 children; $15 for 4th and each additional child

c. MFTC – guarantees a minimum of $658 after tax per week. It is abated dollar for dollar for extra earned income. The FTC and IWTC are in addition.

d. BSTC - $73.00 for child under one; this is maximum for children between one and three years old.

6. How are the payment rates increased?

a. Rates of FTC and BSTC are increased when inflation cumulatively (over time) exceeds 5%.

b. IWTC is reviewed every three years; this does not necessarily lead to an increase.

c. MFTC is reviewed annually; and generally leads to an increase.

7. Who is responsible for payment of WFF?

a. The Inland Revenue Department is responsible for WFF payments; FTC for beneficiaries is administered through MSD but payment is made by IRD. It is paid directly into the recipient’s bank account.

8. What do we mean by abatement in relation to WFF?

a. Using what is called an income test, abatement refers to the rate by which the tax credits are reduced as a recipient’s income increases. The FTC is reduced first, and then the IWTC, by 27 cents for every dollar earned above the current threshold of $42,700 combined annual gross income.

9. What do we mean by thresholds in relation to WFF?

a. Threshold refers to the level of income at which the amount that is paid to the recipient decreases as income increases. It is akin to moving into a higher tax bracket in that the level of payment for which the caregiver is eligible decreases as the family’s income moves to a higher level. The current threshold is $42,700.

10. How do earnings affect WFF eligibility and entitlement?

a. See 8 above re abatement.

11. What happens if income changes during the year?

a. Sometimes the Inland Revenue can adjust WFF payments so that the amount is not over or underpaid. If IR are not informed, additional income can result in a debt to the IR that has to be repaid. There can also be a reimbursement if there is an over-payment.

12. Where can I find more information about WFF?

a. Go to www. https://www.ird.govt.nz/working-for-families/about

13. What existed before WFF? (Note: Names and eligibility criteria have changed over time)

a. Family Care was introduced in 1984; replaced by Family Support in 1986.

b. The Family Benefit (established in 1938) was as a universal $6 per child per week from 1979. It was paid without an income test, until its abolition in 1991, when it was added to Family Support.

c. In 1996 the Child Tax Credit was introduced as a $15 per child per week payment but only for those who were ‘independent from the state’.

d. In 1999, Family Plus was used to describe tax credits that were only for those who met paid work criteria and received no welfare benefit. These were the Parental Tax Credit, Child Tax Credit and Family Tax Credit.

e. Under Working for Families, 2004, the Family Tax Credit replaced Family Support and became the main payment for children. The Minimum Family Tax Credit replaced the old Family Tax Credit. In 2006, the In Work Tax Credit replaced the Child Tax Credit [For fuller historical details, see https://www.weag.govt.nz/assets/documents/WEAG-report/background-document] and Cut Price Kids 2004 CPAG